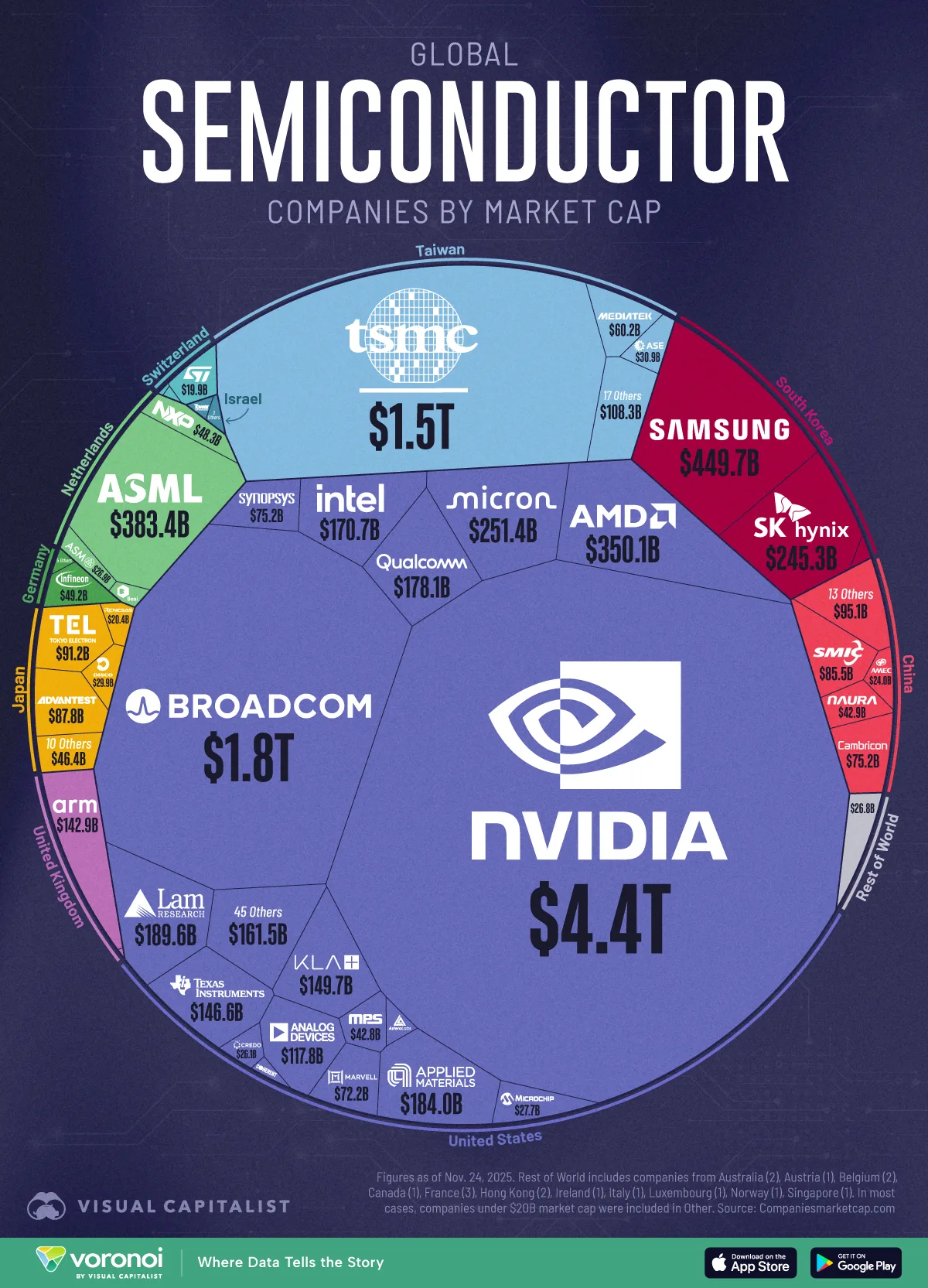

The global semiconductor industry has crossed an unprecedented milestone, surpassing $12 trillion in total market capitalization as of November 24, 2025. The sector — powering everything from smartphones and electric vehicles to artificial intelligence and defense systems — continues to solidify its role as the backbone of modern technology.

A new visualization sourced from CompaniesMarketCap.com highlights the immense value concentrated in a relatively small number of countries, with the United States, Taiwan, South Korea, and the Netherlands controlling the overwhelming majority of the world’s semiconductor market.

Nvidia Leads the Pack

The most striking number in the dataset comes from Nvidia, which alone is valued at $4.4 trillion, accounting for 37% of the entire global semiconductor industry.

Nvidia’s dominance reflects the explosive demand for AI accelerators and data center GPUs, which power everything from large language models to autonomous driving systems. The company’s meteoric rise through 2024 and 2025 has reshaped the semiconductor landscape and turned it into one of the most valuable companies in history.

Other major U.S. players include: Company Market Cap Broadcom $1.8 trillion AMD $350 billion

All three leaders — Nvidia, Broadcom, and AMD — operate under a fabless business model, designing chips in-house while outsourcing manufacturing to foundries such as TSMC.

Taiwan: The Manufacturing Powerhouse

With a market capitalization of $1.48 trillion, Taiwan Semiconductor Manufacturing Company (TSMC) remains the world’s largest and most influential chipmaker. TSMC manufactures a significant portion of the world’s most advanced chips and is expanding aggressively, including two new Arizona fabs backed by the U.S. CHIPS and Science Act.

Taiwan’s second-largest player, MediaTek, continues to be one of the top global suppliers of smartphone and connectivity chipsets.

South Korea and the Netherlands Play Strategic Roles

South Korea remains a global leader in memory chips, with its two largest companies — Samsung ($449.7B) and SK Hynix ($245.3B) — maintaining a near-duopoly in high-performance DRAM and NAND technologies.

Meanwhile, Europe’s semiconductor strength lies in critical equipment manufacturing rather than chipmaking. The Netherlands’ ASML — valued at $383 billion — remains the sole supplier of EUV lithography machines, the most advanced chip-printing systems in the world. Due to U.S.-led export restrictions, the company does not sell its most advanced machines to China.

China Expands but Faces Export Restrictions

China’s semiconductor companies have shown rapid growth despite geopolitical pressure. SMIC ($85.5B), Cambricon, NAURA, and AMEC are among the country’s highest-valued chip firms.

However, export controls led by the U.S. — particularly on high-end lithography tools and AI accelerators — continue to slow China’s access to cutting-edge semiconductor manufacturing.

A High-Stakes Industry

With AI, automation, electrification, and cyber defense driving global demand, semiconductors are no longer just a business — they are a matter of national strategy.

From the CHIPS Act in the U.S. to Japan’s technology subsidies and South Korea’s semiconductor stimulus packages, countries are investing heavily to secure supply chains and reduce dependency.

With the total semiconductor market already above $12 trillion, analysts expect competition to intensify as nations and corporations race to control the future of computing.