New Delhi : India’s largest private airport operator, the Adani Group, has sought the government’s approval to allow foreign airlines to operate more international flights to and from India. The move is linked to the group’s massive investment in airport infrastructure, but it has triggered resistance from major Indian carriers such as Air India and IndiGo, who fear unfair competition.

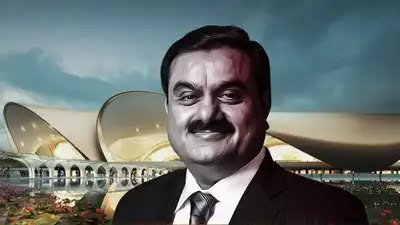

Adani Airports Holdings Limited currently operates eight airports across the country and is investing billions of dollars to upgrade terminals, runways, and passenger facilities. According to a report, the group has urged the government to initiate talks with countries including the UAE, Saudi Arabia, Qatar, Singapore, Indonesia, and Malaysia to increase bilateral air service rights. Adani believes that expanding international flight capacity could help transform Mumbai into a global aviation hub.

The Adani Group plans to invest around $11.1 billion by 2030 in airport development. Company officials argue that without an increase in international flights, this large-scale investment will be underutilized. They also claim that limited flight options keep airfares high for Indian passengers and restrict global connectivity.

However, India’s leading airlines are not fully aligned with this view. Tata Group-owned Air India and budget carrier IndiGo have advised the government to proceed cautiously. Air India, in particular, has warned that allowing more foreign flights—especially by well-funded Middle Eastern carriers—could result in unfair competition. These airlines already dominate long-haul traffic between India, Europe, and North America through their hubs in Dubai, Doha, and Abu Dhabi.

International flight rights are governed by bilateral air service agreements between countries. Since coming to power in 2014, the Narendra Modi-led government has taken a conservative approach in granting additional flying rights to foreign airlines, especially those based in West Asia. The government maintains that this policy is aimed at protecting Indian carriers and developing domestic airports into international transit hubs, similar to Dubai or Singapore’s Changi Airport.

The debate highlights a key policy dilemma: balancing infrastructure-led growth and consumer choice with the need to nurture and protect India’s domestic aviation industry. A final decision could significantly shape the future of India’s role in global air travel.

Q1: Why does the Adani Group want more international flights in India?

The Adani Group wants more international flights to ensure better utilization of its airport investments, attract higher passenger traffic, reduce airfares through competition, and position cities like Mumbai as global aviation hubs.

Q2: Why are Air India and IndiGo opposing this move?

Air India and IndiGo fear that increased access for foreign airlines—especially powerful Middle Eastern carriers—would create unfair competition and hurt the growth and profitability of Indian airlines.

Q3: What is the government’s stance on this issue so far?

The government has been cautious about expanding foreign airlines’ flight rights, aiming to protect Indian carriers and develop domestic airports as international transit hubs, rather than allowing foreign hubs to dominate Indian air traffic.