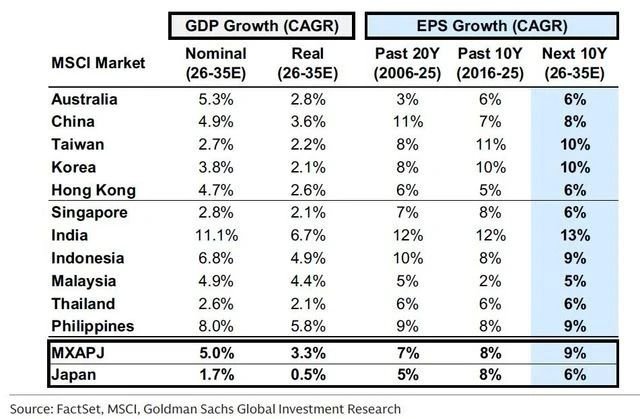

Global equities are likely to deliver a return of 7.1 per cent per annum in the next 10 years in local currency (7.7 per cent in US dollar terms), according to analysts at Goldman Sachs.

India, it believes, is an outlier and could outperform – posting the best earnings per share (EPS) growth in the Asia Pacific (APAC) region in the next 10 years at 13 per cent compounded annually (CAGR).

And if their EPS prediction proves correct, the Sensex could be trading around the 300,000 mark by then (2036), closely mirroring the EPS growth compounded annually at 13 per cent. Earnings growth, meanwhile, remains the primary driver of performance, Goldman Sachs argues, as they expect global earnings—including the impact of buybacks—to compound at around 6 per cent annually. The remainder of returns, the research and brokerage said, would come from dividends, as valuations ease from current highs.