Taipei, Taiwan: As artificial intelligence drives record investment and market gains, concerns are growing in Taiwan that the AI frenzy could turn into a bubble—raising echoes of the dot-com crash that rocked global markets in 2000.

Those worries were voiced publicly by TSMC Chairman C.C. Wei, who acknowledged investor anxiety during an earnings call in January. “I’m also very nervous about it,” Wei said, noting that the company plans to invest between $52 billion and $56 billion this year alone. “If we did not do it carefully, that will be a big disaster to TSMC for sure. I want to make sure that my customers’ demands are real.”

Taiwan, a global hub for semiconductor manufacturing, has been one of the biggest beneficiaries of the AI boom. But the scale of spending—and the speed of market gains—has fueled debate over whether demand will remain durable.

Ratings Agencies Urge Caution

In a recent report, analysts at Fitch Ratings said AI demand is likely to remain strong in the near term. Over the longer run, however, risks will hinge on how AI technology evolves, as well as on trade policies, investment rules, and how quickly Taiwanese firms adapt to changing conditions.

Suppliers See No Slowdown

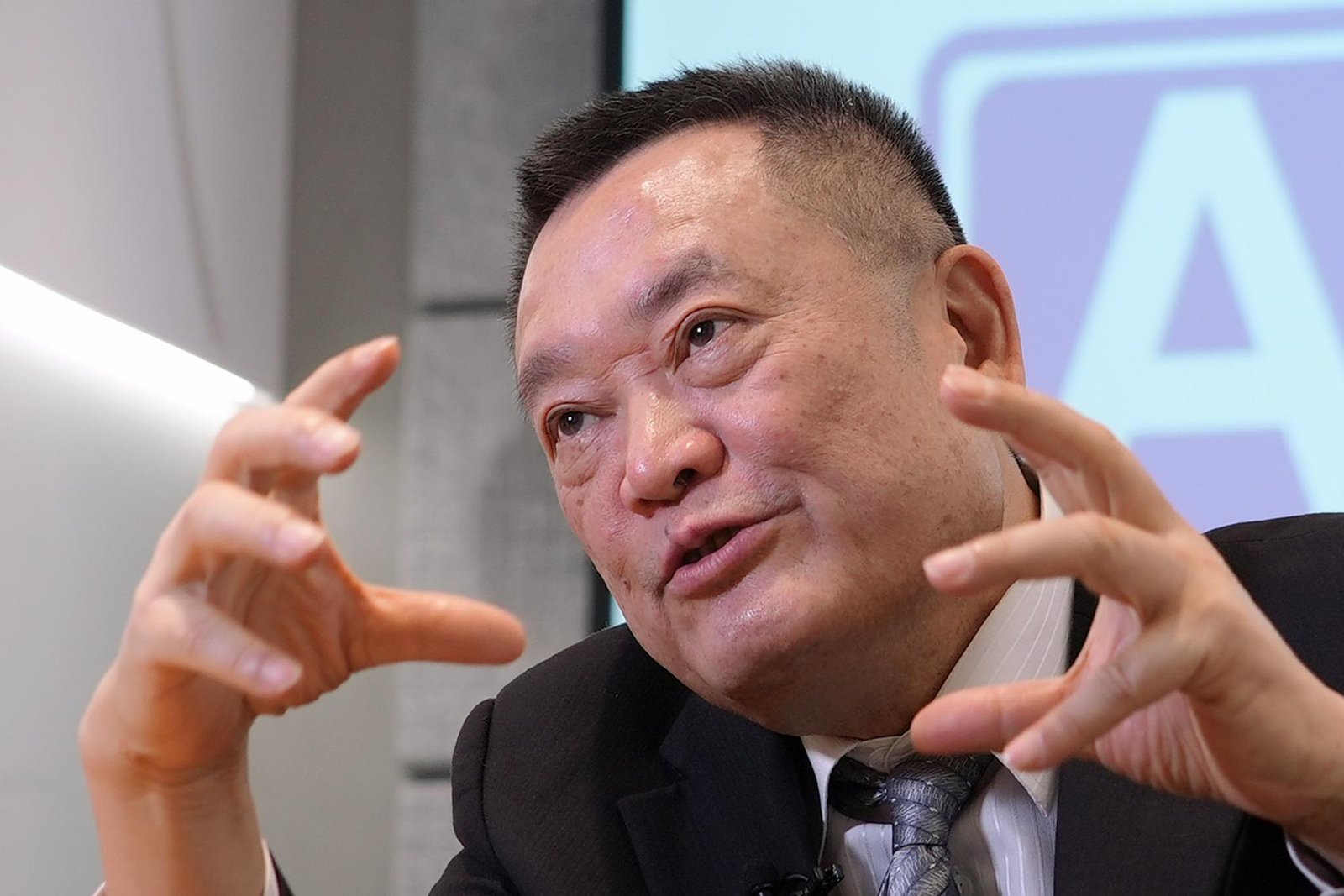

On the industry side, key suppliers say demand remains robust. Asia Vital Components (AVC), a major supplier of liquid cooling systems for Nvidia, is ramping up research and development. AVC Chairman Spencer Shen said the company is already designing thermal solutions for AI servers expected in 2028.

“We do not believe this is a bubble,” Shen told The Associated Press. “AI is driven by companies with real products and massive cash flows, like Amazon, Microsoft, Google, and Meta.”

“In fact, AI infrastructure is still in short supply,” he added, predicting that AI will fundamentally change daily life.

Geopolitics Add Uncertainty

Beyond market risks, geopolitical tensions also cloud Taiwan’s outlook. Many in Taiwan believe the island’s central role in global chipmaking provides a form of protection against military action by China, whose leaders have vowed to reunify the island with the mainland, by force if necessary.

The two sides split in 1949 after a civil war, and Beijing has stepped up military pressure in recent years. Despite this, Taiwan’s former president Tsai Ing-wen and others argue that the global reliance on Taiwanese chips would deter an attack due to the massive disruption it would cause.

“The chip supply chain would be severely hit,” said analysts, noting that both global tech firms and Chinese industries would suffer.

Companies Prepare for Contingencies

Even so, some Taiwanese companies are quietly preparing contingency plans. TSMC already operates plants in China, Japan, and the United States, and is expanding production in the U.S., Germany, and Japan. Foxconn—best known as a major Apple supplier—still manufactures about 65% of its products in China but has expanded operations in India, Mexico, and the U.S. AVC has been increasing capacity in Vietnam.

Market Gains, Uneven Benefits

The AI surge has powered Taiwan’s stock market to new heights. The benchmark Taiex has climbed nearly 250% over the past decade, making many investors wealthy. Economists have also upgraded forecasts for Taiwan’s 2026 economic growth, citing strong AI-driven exports.

But the prosperity has not been evenly shared. Official data show Taiwan’s wealth gap has roughly quadrupled over the past 30 years, leaving many residents feeling left behind even as the tech sector booms.

As Taiwan rides the AI wave, policymakers, executives, and investors are grappling with the same question: is this a sustainable transformation—or a bubble that could one day burst?